So You’ve Defined Your Purpose - What Next?

Ok, you’ve set the stage for financial independence by defining your purpose, the reason why you want to achieve that level of wealth. What’s next? You need to stop the bleeding! If you have credit card debt, you’re currently hemorrhaging money. You’re giving away your hard-earned cash to companies charging you an insane interest rate to borrow money from them. More on this below...

What’s Revolving Credit Card Debt?

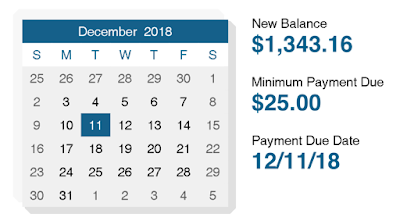

If you have a credit card, you’ve probably heard the term “revolving debt.” Take a look at the below statement and you’ll see two dollar amounts: “New Balance” - $1,343.16 & “Minimum Payment Due” - $25.00. If I only pay the credit card company the second amount, the $25.00 minimum, I will still owe $1,318.16 (my balance of $1,343.16 minus the minimum payment of $25.00). This money I still owe is carried forward to my next credit card statement and is known as revolving debt.

|

| Credit Card Statement Balance |

Why Credit Card Debt is the Worst

If I only need to pay $25 on a $1,343.16 balance, that’s pretty good, right? WRONG! The interest rate that credit cards charge you to keep a revolving balance, known as your annual percentage rate, or APR, is ridiculously high. In a recent report, the average APR for existing credit cards was 13.08%, and 19.05% for new ones. To explain just how absurd this is, recent 30-year mortgage rates averaged between 4% and 5.5%, and you get a house with that!

So, going back to the above $1,343.16 balance, take a look at the below chart to see what would happen if I only paid the $25 minimum balance every month. If I made no additional purchases on this card and made the minimum payment each month, it would take me 8 years to pay off the debt, and I’d pay a total of $2,434. That means that I would have to pay the credit card company $1,090.84 in interest (total payments of $2,434 minus actual debt of $1,343.16)!

|

| Credit Card Payment Plan |

Stop the Bleeding

Now that you see how much money you’re wasting if you have revolving credit card debt, you need to stop the bleeding. What does that mean? If you have revolving debt, STOP USING YOUR CREDIT CARD! Take it out of your wallet or purse, lock it up in a safe, give it to a loved one you trust for safe-keeping - just do something so that you don’t use it anymore. And for you online one-click shoppers, make sure any accounts linked to a credit card are also disabled. Bottom line, before you can start crawling your way out of debt towards financial independence, you need to first stop digging yourself into a deeper hole.

Questions? Thoughts? Recommendations for another topic? Let us know in the comments!

Next Article

Previous Article

No comments:

Post a Comment